Loans

The William D. Ford Federal Direct Loan Program

The William D. Ford Federal Direct Loan Program is divided between subsidized and unsubsidized loans. These loans provide assistance to students in meeting educational expenses. Interest is deferred on the principal of the subsidized loan while the student maintains continuous enrollment. Depending on eligibility or unmet cost of attendance, an undergraduate student may borrow up to:

- $5,500 a year during the first year;

- $6,500 a year during the second year

- $7,500 a year for students with junior or senior status

William D. Ford Federal Direct PLUS Loans

Direct PLUS Loans are loans for the parents of dependent students and for graduate/professional students. PLUS loans help pay for education expenses up to the cost of attendance minus all other financial assistance. Interest is charged during all periods. The student must complete a Free Application for Federal Student Aid (FAFSA --- www.fafsa.ed.gov) to determine eligibility for financial aid funds.

For more information related to the William D. Ford Direct Loan program, please click on the Student Aid site.

If you have financial need remaining after your EFC and any Grant funds, you can borrow to cover some or all of that remaining need. This type of loan is a subsidized loan. The government will pay the interest while you're in school, for the first six months after you leave school, and when you qualify to have your payments deferred. Depending on your financial need, you may borrow subsidized money for an amount up to the annual loan borrowing limit for your year in school.

You might also be able to borrow loan funds beyond your subsidized loan amount even if you haven't demonstrated financial need. In that case, you would receive an unsubsidized loan. Your school will subtract the total amount of your other financial aid from your cost of attendance to determine whether you are eligible for the loan. You are responsible for the interest from the time the loan is disbursed until it is paid in full. You can choose to pay the interest or allow it to accumulate and be capitalized (added to the principal amount of your loan).

Parents who have an acceptable credit history can borrow a PLUS Loan to pay the education expenses of a child who is a dependent student enrolled at least half time in an eligible program at an eligible school. The parent(s) will fill out a PLUS Loan application (found under Forms on the Home Page) and submit it to the Office of Scholarships & Financial Aid. A credit check is required. The yearly limit on a PLUS Loan is equal to your cost of attendance minus any other financial aid you receive. If your cost of attendance is $6,000, for example, and you receive $4,000 in other financial aid, your parents can borrow up to $2,000. The school receives the money in at least two installments. If any loan money remains, your parents will receive the amount as a check or in cash, unless they authorize that it be released to you.

Graduate Plus Loans are federally sponsored loans for students who are attending graduate school. With a Grad Plus loan, you may borrow up to the full cost of your education, less other financial aid received including Federal Stafford loans. A credit check is required to borrow a Grad plus Loan and you may be eligible for the loan if you are enrolled in school at least half time. You must submit a FAFSA.

Consumer Information

All student loans will be processed through the US Department of Education (William D. Ford Federal Direct Loan Program). All students have the right to cancel their Federal Direct Stafford Loan within 14 days from the date of disbursement. To cancel a loan(s), student must notify Fayetteville State University, Office of Scholarships & Financial Aid in writing.

Federal Direct Subsidized/Unsubsidized Stafford Loan Requirements

In order for us to process your loan request, you must complete Entrance Counseling and a Master Promissory Note (MPN).

To complete Entrance Counseling and the MPN:

- Visit www.studentloans.gov

- Your FSA ID will be required to complete both Entrance Counseling and the MPN

- If you need to apply for a FSA ID, please visit https://fsaid.ed.gov/npas/index.htm

- Contact a financial aid representative if you have any questions at 910-672-1325

Federal Direct PLUS Loan Requirements

In order for us to process your loan request, you must have a Master Promissory Note (MPN).

To complete the MPN:

- Visit www.studentloans.gov

- Your FSA ID will be required to complete both Entrance Counseling and the MPN

- If you need to apply for a FSA ID, please visit https://fsaid.ed.gov/npas/index.htm

- Contact a financial aid representative if you have any questions at 910-672-1325.

Exit Counseling Requirement

The Department of Education requires all students who have borrowed student loans at Fayetteville State University complete an Exit counseling, which provides important information about repay your federal student loan(s). If you have received a subsidized, unsubsidized or PLUS loan under the Direct Loan Program, you must complete exit counseling each time you:

- Drop below half-time enrollment

- Graduate

- Leave School/Withdraw

Please complete exit counseling at www.studentloans.gov and your school will receive your information electronically within 5 to 7 business days.

COHORT DEFAULT RATE

- Cohort default rates are determined based on data reported to the National Student Loan Data System (NSLDS) by guaranty agencies.

- Guaranty agencies consist of state and private agencies that help facilitate the Federal Family Education Loan Program.

- Cohort default rates are calculated bi-annually.

- Loans included in these calculations are all Federal Stafford subsidized loans, unsubsidized loans, and federally consolidated loans.

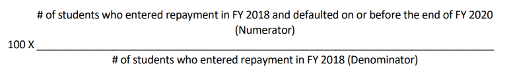

- The formula for calculating the CDR is comprised of the number of students entering repayment and default by a given time frame during a fiscal year divided by the number of students who entered repayment (please refer to the example below).

Fayetteville State University Latest Cohort Default Rate Data

OFFICIAL COHORT DEFAULT RATE DATA